As one of the world’s oldest industries, agriculture remains the backbone of many economies. With a diverse value chain encompassing input supply, livestock farming, crop cultivation, processing, aggregation, and even small-scale vending, agriculture spawns several SMEs. For business owners, including agripreneurs, running a lean and efficient operation is key, which makes a reliable accounting system essential. Traditional record-keeping and manual books have served their purpose, but digital accounting now elevates the entire process to a level of speed, accuracy, and convenience that was previously unimaginable.

What is it?

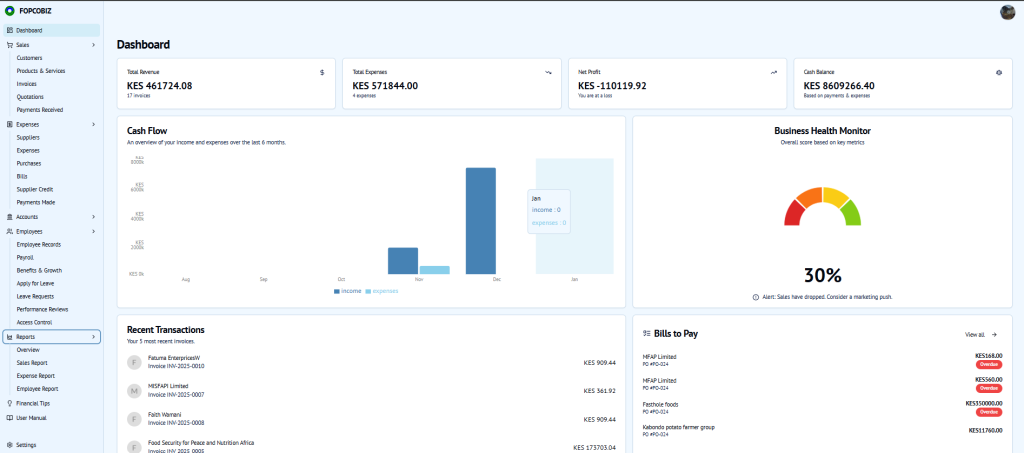

A digital accounting system utilizes programmable software, allowing you to record, track, and analyze financial activities. Think of a platform that aggregates ledgers, receipts, invoices, and other books of account on a single platform that is easily accessible. Rather than painstakingly recording every single transaction, a digital accounting system simplifies your work by automating this process to highly accurate levels. Such a system can record sales, track expenses, generate invoices, manage inventory, and produce financial reports all at the tips of your fingers.

A digital accounting system embodies multiple features to help you in running your business and organizing your financial data. One such feature is the ability to record sales, write receipts, and generate invoices instantly. Consider an agro-dealer offering different products such as seeds, fertilizer, and equipment. A digital accounting system helps them instantly record sales for each item, also allowing them to conveniently track the respective stock levels. Additionally, with a digital accounting system, businesses can track expenses by logging purchases and costs such as labour, transport, fees, and utilities. A milling or processing enterprise can track what they spend on raw materials and utilities such as power and water. They can also utilize the accounting system in managing staff and payroll, conveniently and efficiently addressing issues like deductibles. Such a system also allows for the automatic calculations of costs and sales totals, balances, and profits. This makes it easier for the business to generate sales reports daily, as well as make cash flow summaries and profit-and-loss statements.

Why You Should Consider A Digital Accounting System for Your Agribusiness

While many agri-SMEs still get the job done by relying on manual accounting methods, these methods present a number of setbacks. Manual accounting is time-consuming, prone to error, and presents difficulties in tracking inventory. Additionally, determining costs and profits requires extensive calculations that are exhausting, making financial reporting challenging.

The inefficiencies of manual accounting processes can be well addressed by a robust digital accounting system. A primary benefit of adopting a digital accounting system for your business is the better financial accuracy it delivers. When keeping manual records, mistakes such as errors of omission can happen. However, a digital accounting system records transactions in real time and automates calculations, resulting in highly accurate financial data. Furthermore, digital tools offer improved management of cash flow by tracking inflows and outflows. As such, you can determine when you’ll be short of cash and make appropriate accommodations.

When handling agricultural products like seeds during, say, a planting season when there’s high demand, it is important to keep a tight handle over the stock levels. A digital accounting system allows you to track the inventory in real time. It alerts you when stock levels dwindle and tracks lots or batches, reducing stockouts, wastage, and even theft. With automated processing, such a system makes reporting and compliance less cumbersome. The clean audit trails from recording transactions as they happen make it easier to generate financial statements. Consequently, even external lenders can have a clear view of your financial position, clearing obstacles towards accessing credit.

You cannot underscore the importance of digital accounting systems enough when it comes to saving time and labour as opposed to manual accounting. Hours wasted digging through receipts, updating books, calculating totals, and reconciling statements are saved for more productive endeavors. The reduced administrative workload means you need fewer support personnel. Additionally, using a digital accounting system enhances decision-making by offering real-time insights, not to mention the credibility it presents. Moreover, the convenience of digital systems, allowing access to your financial data anywhere, anytime, is one that any agripreneur will appreciate.

Embracing digital accounting not only streamlines day-to-day activities but also creates a conducive base to build for the future. As an agripreneur, having accurate financial data, including smooth cash flows and close inventory control, is essential in making better decisions. It also puts you in a position to stand out when it comes to securing credit and attracting investment in the highly competitive sector. Digital accounting systems free up time previously allotted to administrative activities, allowing you to focus on your core mandate and drive your operations into a more profitable venture.